FSW Markets

Real-time market intelligence & data strategy

The Fashion Strategy Weekly Markets service (FSW Markets) delivers real-time insights tailored specifically for the luxury industry. By tracking key economic indicators, consumer sentiment, and global market shifts, we provide an exclusive view into the cyclical and structural trends shaping luxury consumer behavior and purchasing power. FSW Markets produces forecasts for the industry using our own structural, econometric forecasting model as well as select machine learning algorithms. We also prepare our own All Luxury stock market index to give a clear picture on major industry market movements.

Gucci delivers the anticipated bad news while Tapestry and Ralph Lauren over-perform

The earnings season for luxury delivered a lot of news today with Gucci, Ralph Lauren, Tapestry, and Tapestry’s target Capri all coming to the market with results. As we reported earlier in the week, the market expected another poor outcome from Kering for its full...

Ferrari Races Ahead of the Rest of the Luxury Industry

So far this earnings season luxury brands, with an exception or two, have beat market expectations for the period of October to December and full year 2023. Ferrari joined the beat-the-expectations club with their earnings announcement today and we even got a bit of a...

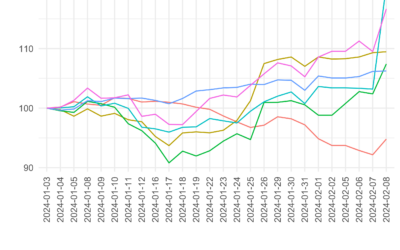

A bull market in luxury stocks in beginning to form

The bull market in luxury stocks continued into Monday with every stock in the FSW High Frequency Luxury Monitor All Luxury Index finishing up on a day with some break taking price appreciation: Dior up over 12%, Moncler 9.4%, Kering 6.6%, Cucinelli 6.3%, and...

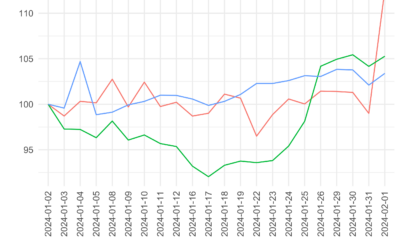

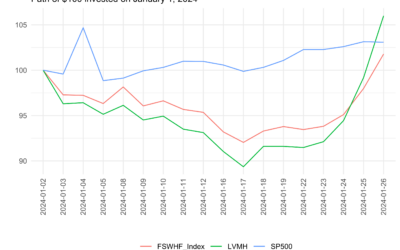

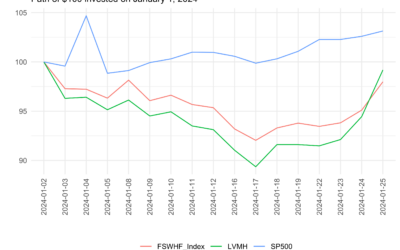

After a strong 2023 earnings report, LVMH’s share price powered past the S&P500 for the year

This was the biggest week of the year for luxury stocks, aided by LVMH's (slight) overshooting of analysts' revenue expectations for 2023. Those results, which were released on Thursday, powered LVMH's share price up by 11.5 percent over Thursday and Friday (as...

At today’s 2023 investors’ call Bernard Arnault expressed no concern of slowing growth at LVMH

Bernard Arnault did not express any concern about slowing growth at LVMH today, pointing out that its pricing power comes from product mix and pursuing a growth at all costs strategy reduces brand exclusivity. After the close of markets in Paris today, LVMH reported...

Ahead of LVMH’s full year 2023 earnings release tomorrow, analysts expect a weak annual growth rate

Tomorrow we will see the highly anticipated full year 2023 results for LVMH after the market's close. With a $360 billion valuation, LVMH is by far the largest player in the highly consolidated luxury market and this release will draw broad attention. What should we...

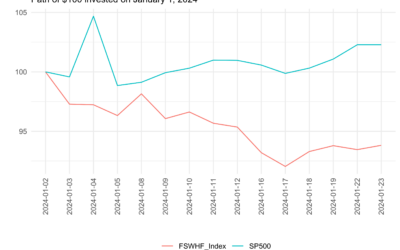

Our new weighted luxury stock market index shows the industry trailing the broader market heading into earnings season

Most "luxury" oriented ETFs include a wide universe of companies that many would not regard as luxury. Though what brands comprise luxury versus premium and so forth is not set in stone, many ETFs include firms such as Tesla and Nike which probably would not fit most...

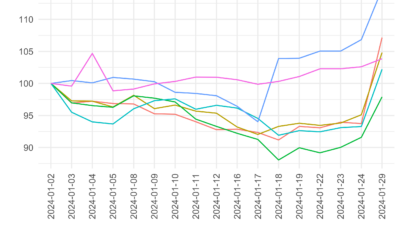

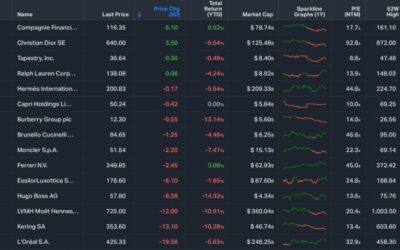

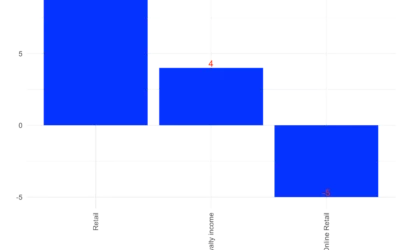

Apart from Richemont, luxury stocks continued to take a beating this week

While the S&P 500 hit a record high at the close of this week, luxury stocks continued to take a beating over the past five with almost the entire sector in the red. Year-to-date returns for LVMH and Kering exceed 10 percent while Hugo Boss is down close to 15...

Richemont reports strong Oct-Dec, driven by strong retail sales

After some mixed results at the start of the luxury earnings season from Burberry (downside surprise) and Brunello Cucinelli (upside surprise), Richemont reported today that October to December 2023 sales were up 8 percent at constant exchange rates with broad-based...

Bank of America forecasts mixed results from luxury in 2024

This nice piece shares BoA’s 2024 outlook for the luxury sector, which finds that while the whole sector will be coming off the post-pandemic bull market to growth rates that are more in line with historical experience, there will be more heterogeneity generally with...