FSW Markets

Real-time market intelligence & data strategy

The Fashion Strategy Weekly Markets service (FSW Markets) delivers real-time insights tailored specifically for the luxury industry. By tracking key economic indicators, consumer sentiment, and global market shifts, we provide an exclusive view into the cyclical and structural trends shaping luxury consumer behavior and purchasing power. FSW Markets produces forecasts for the industry using our own structural, econometric forecasting model as well as select machine learning algorithms. We also prepare our own All Luxury stock market index to give a clear picture on major industry market movements.

We are coming into a new earnings season and expectations are generally for the continuation of the weak sales growth in the luxury industry

FSW High Frequency Luxury Monitor will be batch assessing the Q2 returns a few times over the course of the season. To get us started, below find a table that shows when to expect some the major releases. We also included each ticker's year-to-date total equity...

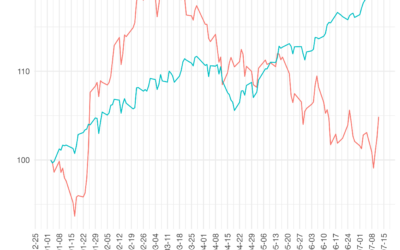

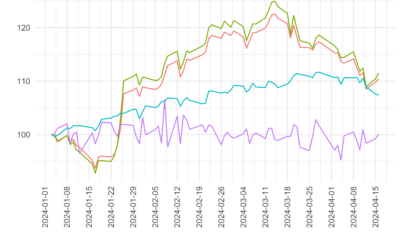

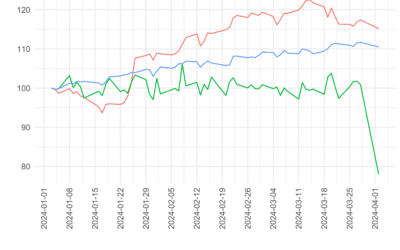

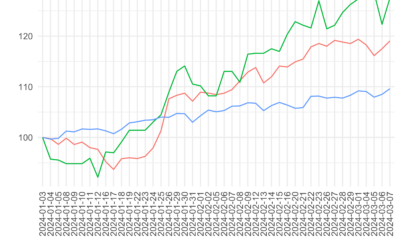

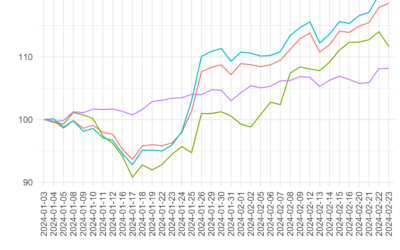

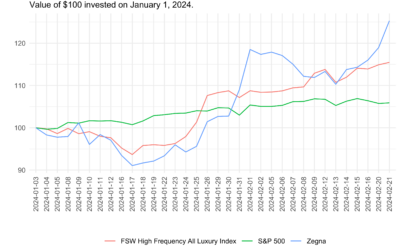

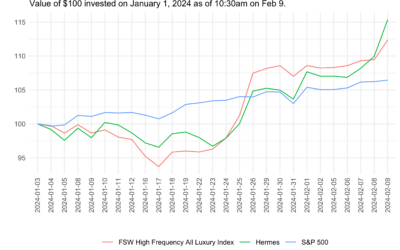

Luxury has had a volatile 2024 as many of the bigger names have underperformed

This year has been a wild ride for the luxury industry. At the start year, expectations were that the industry would heavily underperform the post-pandemic boom years. Expectations were that sales growth, particularly to “aspirational” consumers, would normalize....

LVMH and Tapestry show that there is reason for some optimism in the luxury industry

Over the past day, markets have seen that while the post-pandemic luxury sales boom is indeed over, the industry continues to grow. First, LVMH released its Q1 2024 results today after Paris trading closed, which showed that organic revenues grew by 3 percent relative...

Luxury Real Estate Acquisitions Continue to be Hot, Putting New Pressures on Content Strategy

On April 4, Kering announced that it would be making Europe’s largest property investment in over two years by buying Via Monte Napoleone 8 in Milan from Blackstone for €1.3 billion. Despite issuing a rare warning in mid-March that Q1 revenues would be down 10 percent...

Luxury Shares Continue to Take a Beating After PVH Profit Warning

The share prices of luxury companies have taken a beating since Kering’s alarming Q1 profit warning on March 19 and this bearish momentum may well continue into this earnings season after PVH Corp announced that 2024 revenues would fall 6 to 7 percent. This is sharply...

What’s happening at Gucci and what does it mean for the rest of the luxury industry?

On Tuesday, Kering issued an alarming profit warning that group revenues would plunge 10 percent in Q1 2024. This is sharply steeper than the 6 percent decline in Q4 and, more alarming still, a sharp departure from many analysts’ expectations for positive growth in...

Prada Group Posts Strong FY23 Growth

The Prada Group reported strong FY23 growth at an investors' call today, with revenues growing by 17 percent (at constant exchange rates), mostly in line with analyst expectations. Adjusted EBIT growth was 26 percent, generating a 22.5 percent margin. Growth was...

Momentum continues for luxury equities apart from Kering, which lost steam on the same day as Sabato De Sarno’s second Gucci show at Milan FW24

Our FSW High Frequency Luxury Monitor finished up 3.2 percent on the week, driven by broad based price appreciation across the index's 18 constituent luxury stocks. The biggest gainers were Zegna (up 6.8 percent after its strong preliminary FY23 earnings report)...

Zegna posts a huge FY 2023

The Zegna Group, about eight months after the addition of Tom Ford Fashion, delivered spectacular preliminary FY23 revenues numbers on February 21. Annual revenue growth came in at 27.6 percent after a monster Q4 of 40.1 percent growth. Even if we focus on just...

Hermès’ FY23 earnings support shows that a focus on high-net worth consumers pays off in this market for soft luxury

With the release Hermès’ FY23 results today, we have now seen the release of most of the major luxury firm’s results this earnings season. We still have a few to go, but we can start to draw some lessons. Going into earnings season, the markets expected that...